Credit Cards I Use Personally in 2025 – By Deepak Thakur

Credit Cards I Use Personally: A Transparent Look at My Financial Toolkit – Curated by Deepak Thakur

I’m often asked which credit cards I use and why.

As a digital marketing analyst and someone who enjoys optimizing finances, I use various credit cards based on spending categories, lifestyle benefits, and reward potential.

This page is a living document — I’ll keep updating it as I add or remove cards.

Why I Built This Page on Credit Cards I Use Personally

This section is for readers who want real, honest opinions — not sponsored lists. I use each of these cards myself and share exactly what works for me.

Axis Bank Credit Cards

1. Axis Bank Flipkart Credit Card

- Best For: Online shopping (Flipkart, Myntra, 2GUD, Swiggy)

- Key Benefits:

- 5% cashback on Flipkart & Myntra

- 4% on partner merchants (Swiggy, Uber, PVR, etc.)

- 1.5% cashback on all other spends

- Complimentary Lounge Access (Domestic) – 4 per year

- Annual Fee: ₹500 (Waived on ₹2L yearly spend)

- Why I Use It: Perfect for my Flipkart orders & food delivery cashback.

2. Axis Bank NEO Credit Card

- Best For: Budget-friendly lifestyle and OTT subscriptions

- Key Benefits:

- Discounts on BookMyShow, Myntra, Zomato

- 1% cashback on online spends

- Free Wynk Music & Amazon Prime trial

- Annual Fee: ₹250

- Why I Use It: Handy for subscriptions and quick online discounts.

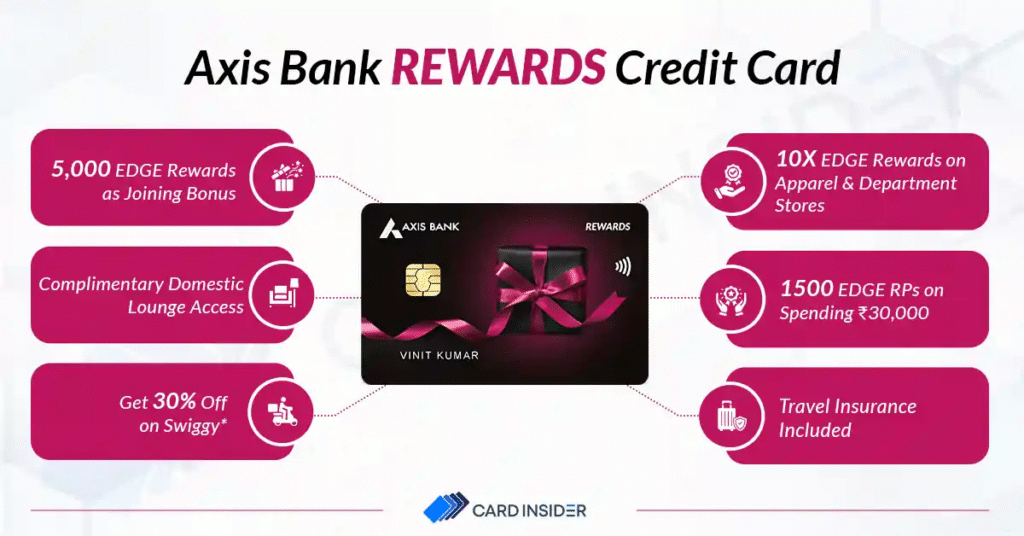

3. Axis Bank Rewards Credit Card

- Best For: General shopping and points lovers

- Key Benefits:

- Up to 20 reward points per ₹200

- Extra points on birthday spends

- Easy redemption for vouchers, travel, etc.

- Annual Fee: ₹1,000

- Why I Use It: For building long-term rewards and festive shopping.

4. Axis Bank My Zone Credit Card

- Best For: Entertainment and lifestyle perks

- Key Benefits:

- Free SonyLIV Premium subscription

- 40% off on Swiggy (T&Cs)

- 1 Complimentary Lounge Access per quarter

- Buy 1 Get 1 on BookMyShow (up to ₹200)

- Annual Fee: ₹500

- Why I Use It: Great for movie plans and casual Swiggy orders.

IDFC FIRST Bank Credit Cards

1. IDFC FIRST Mayura Credit Card

- Best For: Lifestyle & premium design

- Key Benefits:

- 10X rewards on online spends & weekends

- Lifetime free card

- Airport lounge access & roadside assistance

- Why I Use It: Stylish card with high rewards on digital spends.

2. IDFC FIRST Club Vistara Credit Card

- Best For: Flight travel and Vistara loyalty

- Key Benefits:

- Complimentary Club Vistara base membership

- Earn CV points on every spend

- Complimentary lounge access

- Why I Use It: Great for domestic travel and Vistara flyers.

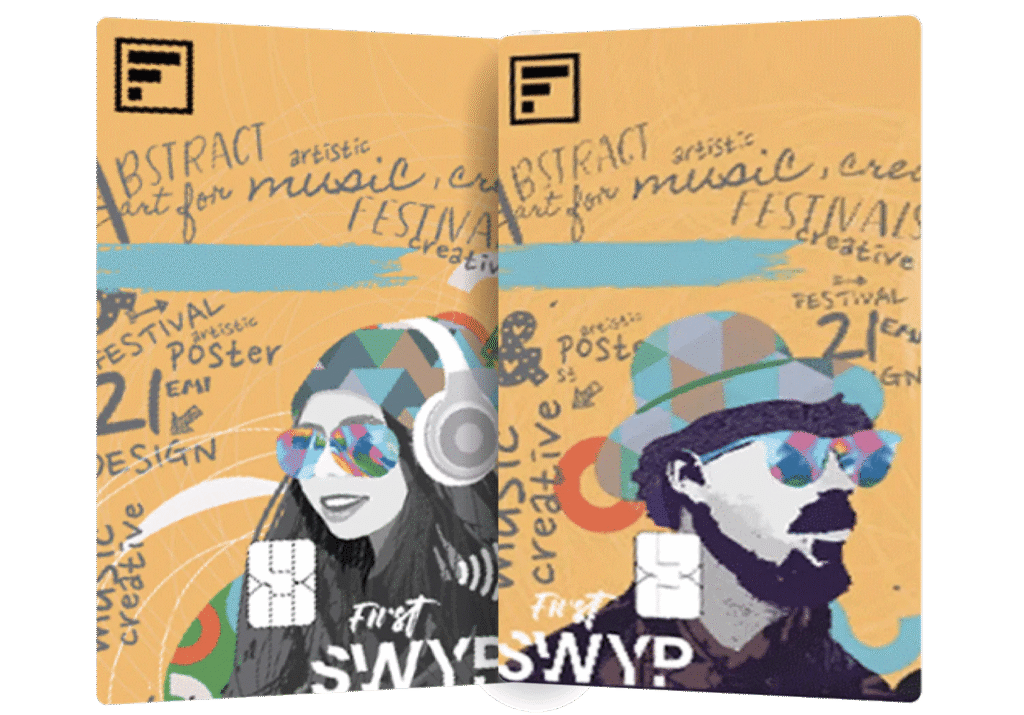

3. IDFC FIRST Swyp Credit Card

- Best For: Gen-Z & digital lifestyle

- Key Benefits:

- 10X rewards on online spends

- Fuel surcharge waiver

- Lifetime free

- Why I Use It: Clean app experience, stylish design, and value-packed rewards.

4. IDFC FIRST Millennia Credit Card

- Best For: Everyday purchases with high reward rates

- Key Benefits:

- 10X reward points on weekends & online spends

- No annual fee

- Instant discounts on partner brands

- Why I Use It: Ideal for regular shopping & weekend spending boosts.

5. IDFC FIRST Digital Credit Card

- Best For: Fully digital experience

- Key Benefits:

- A virtual card is issued instantly

- Great for online transactions

- Lifetime free

- Why I Use It: Smooth onboarding and app-only card – good for controlled usage.

6. IDFC FIRST WOW Credit Card

- Best For: Beginners & those new to credit

- Key Benefits:

- Secured credit card (FD-backed)

- No annual fee

- 4X reward points on all spends

- Why I Use It: Good for building a credit score and getting rewards simultaneously.

HDFC Bank Credit Cards

1. HDFC Swiggy Credit Card

- Best For: Food delivery and online foodies

- Key Benefits:

- 10% cashback on Swiggy app orders

- 5% cashback on online spends

- Complimentary Swiggy One membership

- Annual Fee: ₹500 (Reversed on ₹2L annual spend)

- Why I Use It: For regular Swiggy orders and max food cashback.

2. HDFC Tata Neu Infinity Credit Card

- Best For: Tata brand shopping and the Tata Neu app

- Key Benefits:

- 5% NeuCoins on Tata brands (Croma, BigBasket, Air India, etc.)

- Complimentary airport lounge access

- 1.5% back as NeuCoins on other spends

- Annual Fee: ₹1,499 (Reversed on ₹3L spend)

- Why I Use It: Perfect for BigBasket groceries and Croma purchases.

3. HDFC Paytm Credit Card

- Best For: Paytm app usage and daily utility payments

- Key Benefits:

- Cashback in Paytm First Points

- Discounts on Paytm Mall & movie bookings

- No-cost EMI offers on Paytm

- Annual Fee: ₹500 (Often reversed with offers)

- Why I Use It: Smooth integration with the Paytm ecosystem for utility and recharge spends.

ICICI Bank Credit Cards

1. ICICI Amazon Pay Credit Card

- Best For: Amazon shopping and Prime members

- Key Benefits:

- 5% cashback for Amazon Prime users

- 3% for non-Prime on Amazon

- 1% cashback on all other spends

- Lifetime free

- Why I Use It: Hassle-free cashback on Amazon + no annual fee.

2. ICICI MakeMyTrip Signature (Mastercard)

- Best For: Travel bookings via MakeMyTrip

- Key Benefits:

- 1,500 MMTBLACK points as a welcome gift

- Free airport lounge access (4/year)

- Travel discounts on hotels, flights, and buses

- Annual Fee: ₹500 (Reversed on ₹2L spend)

- Why I Use It: Perfect for planned trips and MMT discounts.

3. ICICI Coral Credit Card (RuPay Variant)

- Best For: Everyday use with RuPay perks

- Key Benefits:

- Free domestic railway & airport lounge access

- Buy 1 Get 1 movie offer on BookMyShow

- Reward points on every ₹100 spent

- Annual Fee: ₹500 (waived on ₹1.5L annual spend)

- Why I Use It: Good mix of lifestyle benefits with RuPay coverage.

4. ICICI MakeMyTrip RuPay Credit Card

- Best For: MMT travel bookings with RuPay benefits

- Key Benefits:

- Complimentary MMTBLACK membership

- Lounge access + travel deals

- Discounts on flights & hotels

- Annual Fee: ₹500

- Why I Use It: When I want to leverage RuPay + MMT offers together.

Kotak Bank Credit Cards

1. Kotak PVR Credit Card

- Best For: Movie lovers and frequent cinema-goers

- Key Benefits:

- Free PVR movie tickets every month (based on spend)

- Buy 1, Get 1 offer on PVR tickets

- Annual spend-based waiver

- Annual Fee: ₹500 (Waived on ₹50,000 annual spend)

- Why I Use It: Great for getting free movie tickets without extra effort.

AU Small Finance Bank Credit Cards

1. AU LIT Credit Card

- Best For: Customizing rewards and tracking via app

- Key Benefits:

- Choose your reward categories (travel, shopping, dining, etc.)

- Real-time control via AU 0101 app

- Free lounge access with add-on packs

- Annual Fee: ₹0 to ₹499 (based on features chosen)

- Why I Use It: Flexible benefits and total control make it fun and efficient to use.

🔄 More Cards Coming Soon

This is just the beginning. I currently use 25+ cards across various banks like HDFC, ICICI, SBI, IDFC, Kotak, and more. I’ll be updating this section regularly with more detailed reviews and experiences.

Stay tuned — or contact me if you want a personal recommendation.

⚠️ Disclaimer: Credit Cards I Use Personally in 2025 – By Deepak Thakur

This page is based on my personal experience. I am not a financial advisor. Please read the terms & conditions of the respective banks before applying.

Also Read: Bike Rides, Travel, Poetry